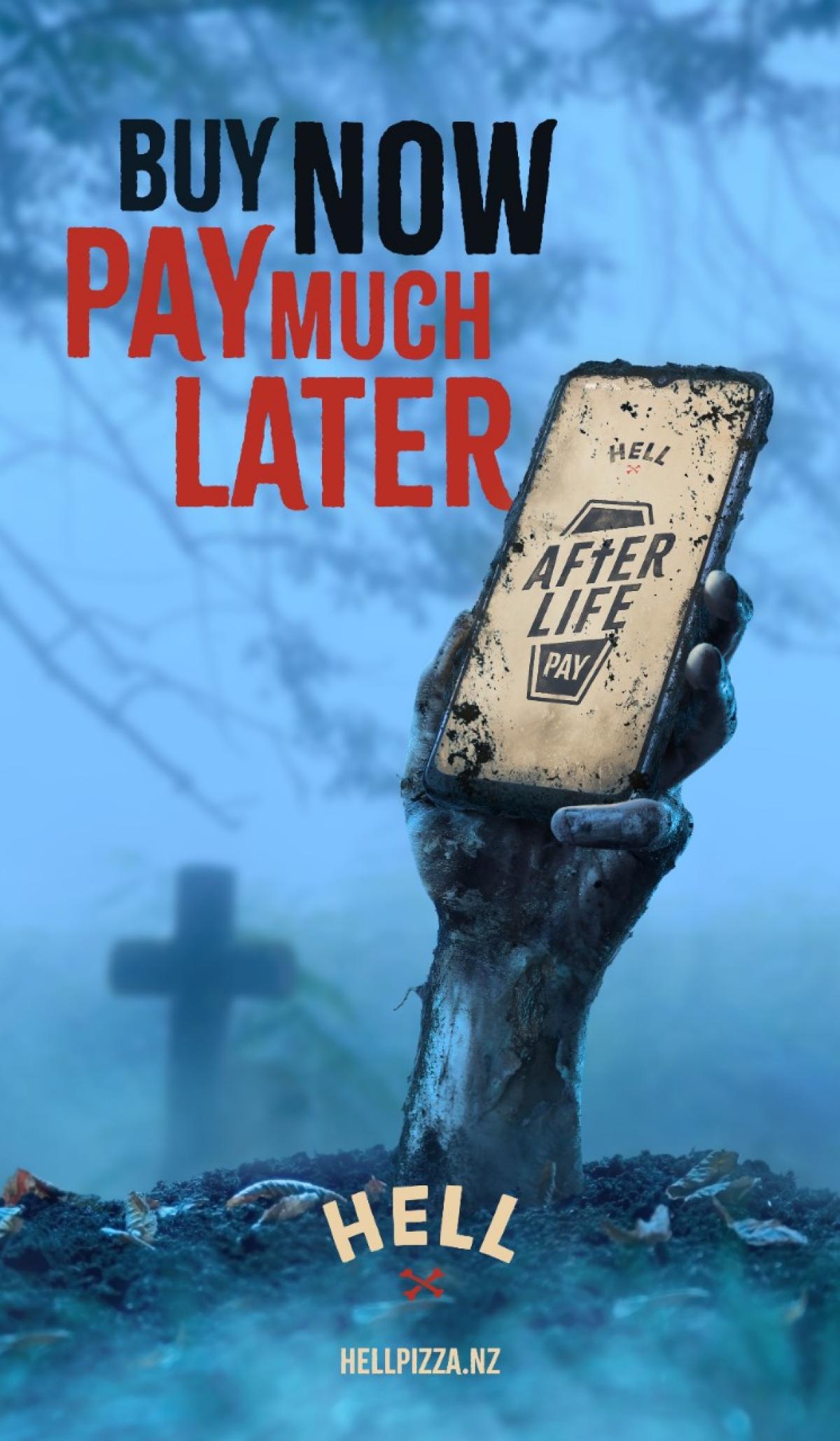

Hell Pizza has hit out at controversial 'buy now, pay later' schemes by offering Kiwis the chance to pay for pizza a lot, lot later - when they're dead.

Hell announced its new 'AfterLife Pay' on Thursday morning, saying they're turning up the "heat" on buy now, pay later (BNPL) schemes - which are trapping a growing number of Kiwis in spirals of debt, particularly amid the cost of living crisis.

AfterLife Pay will only be available to a select number of people: those who are selected will be invited to sign a real amendment to their wills, allowing the cost of their pizza to be collected upon death. No interest or fees will apply, and the agreement is legally binding, Hell said.

Hell CEO Benn Cumming said AfterLife Pay was born after they were approached by BNPL providers who wanted to offer the service to its customers.

"We're seeing a growing number of people using the schemes to buy essential items like food, and we think it's taking it a step too far when you've got quick service restaurants like ours being asked to offer BNPL for what is considered a treat - especially when you consider people are falling behind in their payments and 10.5 percent of loans in NZ are in arrears," Cumming said in a statement on Thursday.

AfterLife Pay will initially run as a trial, with anyone 18 years or older eligible to apply. Of the applicants, 666 people will then be selected. The offer has also been extended to 666 people in Australia.

Those who are selected will then sign a legally binding agreement online for the total of their chosen order.

Cumming said pizza is one of the simple joys of life, and AfterLife Pay means customers can get their fix without having to dip into the bank account immediately.

"AfterLife Pay is a light-hearted campaign that reinforces Hell's stance on buy now pay later schemes - you can have your pizza and eat it too without any pesky late fees or penalties," Cumming said.

It comes as New Zealanders battle the ongoing cost of living crisis, with food prices 12.5 percent higher in April this year compared to 2022. The surging costs reflected higher prices for fruit and vegetables, eggs and potato chips, according to Stats New Zealand.

This increase was the largest since September 1987, which included the introduction of GST in 1986.

Fruit and vegetable prices surged 22.5 percent year-on-year and grocery prices were up 14 percent.

The skyrocketing prices have seen many Kiwis turn to BNPL schemes to afford the basics. BNPL companies typically offer on-the-spot, interest-free short-term loans with minimal credit checks that spread payments over weeks or months and are largely used by cash-strapped people taking debt, sometimes more than they can afford.

Just over 25 percent of New Zealanders had a BNPL account, a figure that had remained consistent over the last 18 months, according to Consumer NZ.

Twenty percent of BNPL users had also accumulated debt from essentials such as groceries, bills and fuel, while 35 percent paid for services with a credit card, according to the stats from Consumer NZ.

BusinessDesk investment editor Frances Cook told AM on Tuesday BNPL services are often used by people who are quite financially vulnerable.

"People who are struggling to feed their families and using it to buy groceries, which is a real sad sign of the times, to be honest," Cook said.

She said these Kiwis can fall into the trap of being sold that it's being "smart" with their money without these schemes mentioning the late fees.

"The buy now pay later schemes are not often sold or marketed as debt. It's sold as you being smart with your money, there's no interest, it's all fine and you can spread out your payments," Cook told AM.

"They don't talk much about the huge fees if you do miss a payment, so I think it is really hitting those people who can least afford to pay, [they] end up having the worst impacts."

She said New Zealand is in an "odd situation" where we have "very little" regulation on BNPL services.

Cook would like to see New Zealand follow in Australia's footsteps by increasing regulations on these schemes.

Australia introduced a new law this week forcing BNPL providers to carry out background checks before lending in what would be one of the world's toughest regimes for the startup sector.