Labour is proposing a new top tax rate of 39 percent on income above $180,000 and the political party is stressing there's no change for the vast majority of Kiwis.

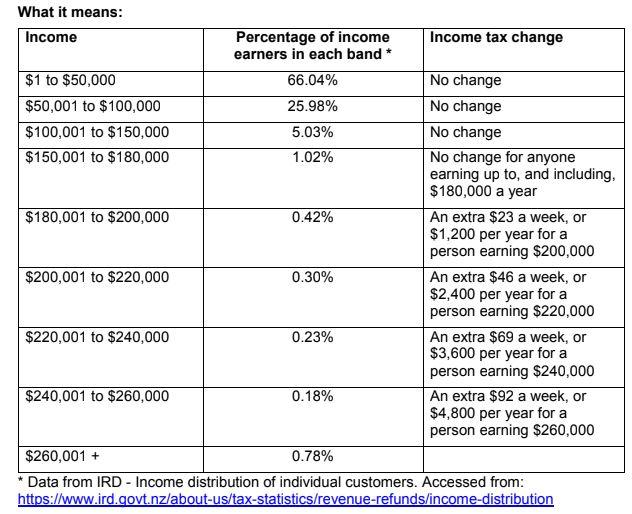

The party's eagerly awaited tax policy was revealed on Wednesday, proposing the 2 percent of Kiwis earning more than $180,000 would see their tax rate increased. Currently, income over $70,000 is subject to a 33 percent tax rate.

Due to New Zealand's progressive income tax system, only income above the $180,000 threshold would be subject to the 39 percent tax rate.

The statement announcing the policy repeatedly emphasises that most Kiwis won't see an income tax change as the other thresholds will remain the same.

"We know New Zealanders want certainty and stability at the moment," finance spokesperson Grant Robertson said on Tuesday.

"This policy is about maintaining investment in important services that are so crucial for New Zealanders like health and education, while keeping tax rates exactly the same as they are now for 98 percent of people."

If Labour is in Government after October 17 and implements the change, the progressive income tax thresholds would look like this:

- Any income up to $14,000 - 10.5 percent

- Extra income over $14,000 and up to $48,000 - 17.5 percent

- Extra income over $48,000 and up to $70,000 - 30 percent

- Extra income over $70,000 and up to $180,000 - 33 percent

- Extra income over $180,000 - 39 percent.

Only those making more than $180,000 move to a new bracket.

Labour also breaks down how much extra Kiwis making more than $180,000 will be paying per week and year.

- A Kiwi earning $200,000: an extra $23 a week or $1200 a year

- A Kiwi earning $220,000: an extra $46 a week or $2400 a year

- A Kiwi earning $240,000: an extra $69 a week or $3600 a year

- A Kiwi earning $260,000: an extra $92 a week or $4800 a year.

If a household's income is, for example, $240,000 with two people earning $120,000 each, they won't be subject to the new tax rate as both individuals earn less than $180,000.

The new bracket is forecast to generate about $550 million of revenue each year.

"The new rate will cost $23 a week for an individual earning $200,000, but it will make a big difference to the country’s ability to maintain the investments needed for the economy to bounce back," Robertson said.

"Labour will not implement any new taxes or make any further increases to income tax next term. We have already committed to not raising fuel taxes in the Government transport plan that covers the next term."

The party says the top tax rate would still remain in the bottom third of the 36 OECD countries, lower than Australia's 47 percent - including 2 percent Medicare levy - for income over $180,000.