House price caps are being removed from the Government's First Home Loan scheme and significantly increased for grants to account for the meteoric rise in house prices over the last year.

According to Treasury's Budget Economic and Fiscal Update (BEFU), house prices rose 29.7 percent over the course of 2021. That growth is expected to slow significantly in 2022 before prices are forecast to drop ever so slightly in 2023, and then rise slowly again.

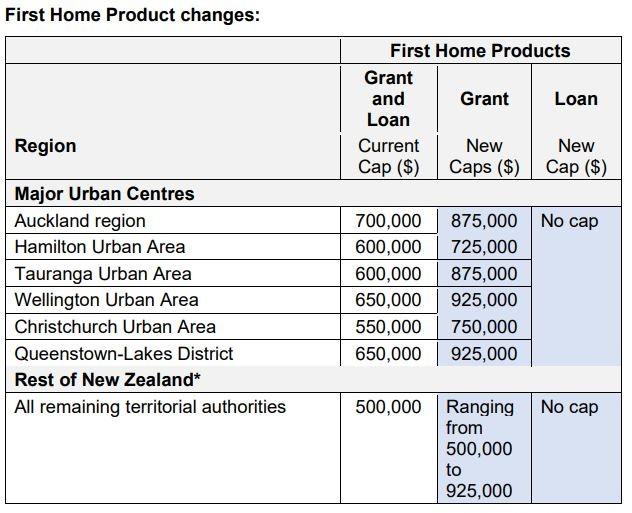

To reflect that, the Government is increasing the house price caps for the First Home Grant and removing them altogether for the First Home Loan.

Under the First Home Grant scheme, New Zealanders who have contributed to their KiwiSaver for at least three years may be eligible for a contribution of $10,000 to top up their deposit. Under the loan initiative, Kiwis only need a 5 percent deposit to purchase their first home.

However, there are caps on the price of a house someone accessing those schemes can purchase depending on where they are buying.

Here's a table highlighting the changes:

"We are increasing the house price caps for the First Home Grant to align with lower quartile market values for new and existing properties. This recognises the changes in house prices over the past year," Housing Minister Megan Woods said.

"We are also removing house price caps entirely from the First Home Loan, to provide a greater choice of homes for prospective first home buyers. Income caps and lender requirements are sufficient to ensure that the First Home Loan is used by buyers who need support for a first home.

"We estimate that these changes, along with other changes to the eligibility criteria, will help thousands more first home buyers, with funding available for approximately 7,000 extra First Home Grants and 2,500 extra First Home Loans available every year."

The house price and income caps will be reviewed every six months to ensure they're up to date. The changes to the First Hom Grant announced on Thursday come into effect from May 19, while the changes to the First Home Loan start on June 1.

Woods also announced he Kāinga Whenua Loan cap will also be increased from $200,000 to $500,000 "to provide more choice and opportunities for people building, relocating, or purchasing a home on whenua Māori".

Among the other changes:

Introduction of an ‘individual earner with dependents category’ with an income cap of $150,000

Adjusting the KiwiSaver requirements to reduce the threshold amount of regular savings to access the grant

Allowing relocatable homes that have received a Code of Compliance certificate in the last 12 months to qualify as new properties

Enabling members of Progressive Home Ownership rent-to-buy schemes to access the new build grant