The National Party has released its tax plan which it says is targeted at the "squeezed middle".

The party revealed its $14.6 billion tax relief plan on Wednesday saying it will be funded by reprioritising spending and introducing targeted revenue measures like a new foreign buyer tax on some houses.

National says an "average household" with children with an income of $120,000 would be better off by up to $250 per fortnight, while an average household with no children will get up to $100 per fortnight and a full-time minimum-wage earner will get up to $20 per fortnight. A superannuitant couple will get up to $26 more per fortnight, the party says.

The 'Back Pocket Boost' package includes changes to income tax brackets to compensate for inflation, introducing National's FamilyBoost child care tax credit, and increasing Working for Families tax credits. This would come in from July 1, 2024.

The National Party is also promising to fully restore interest deductibility for rental properties, bring the bright line test back to two years from the current 10 years, not go ahead with the Government's proposed fuel tax hikes over the next three years and remove the Auckland Regional Fuel Tax, if it's elected in this year's General Election.

One of the main elements of the tax relief package is adjustments to tax thresholds. This is expected to cost nearly $9 billion over the four forecast years.

Currently, the bottom threshold is $14,000. This would change to $15,600 under National's plan. The $48,000 threshold would change to $53,500 and the $70,000 threshold would change to $78,100.

National already announced the FamilyBoost child care tax rebate earlier this year, promising families earning up to $180,000 a 25 percent rebate on early childhood education expenses up to $3900 per year depending on income. That would be $75 per week.

The policy document released on Wednesday says National "will end Labour’s extension of 20 Hours ECE to two-year-olds" as their FamilyBoost rebate will replace this.

On Working for Families, National would increase the in-work tax credit by $25 per week from April 1, 2024. It would also increase the abatement threshold to $50,000 from April 1, 2026. This is the same as what Labour is proposing.

The party's policy document included specific examples of how its policy would affect different New Zealanders.

One of the examples was a family of four made up of Wiremu, Mia and their two school-aged children.

National says the family would be $100 better off each fortnight under their tax policy.

Wiremu and Mia both work full-time, earning $60,000 each, for an average household income of $120,000. They have two primary school-aged children.

Under National’s tax plan, they would get tax relief of $1600 a year and Independent Earner Tax Credits of $1040.

Overall they would get an extra $2640 per year in tax relief and credits.

Another example is Matthew and Sarah who each earn an average full-time income of $75,000 and spend $200 per week on childcare for their three-year-old.

They would get an extra $170 a fortnight under the policy made up of $1900 of tax relief and FamilyBoost childcare tax credits worth $2600.

Overall they would get an extra $4500 per year.

Building apprentice Alice is another example who National says would be better off by around $50 a fortnight if they were elected.

The Christchurch apprentice earns $55,000 per year and would pay $800 less in income tax as well as being eligible for the $520 Independent Earner Income Tax Credit.

Overall Alice would get an extra $1320 per year.

Next up is Bob and Jacqui, a retired couple living in Whakatāne, who would get an extra $26 a fortnight.

"Since NZ Superannuation payments are linked to average after-tax wages, they will receive a benefit from National’s plan to deliver tax relief for the squeezed middle. Under National, Bob and Jacqui will be better off by a combined $680 per year," the party says.

Cafe worker Nathan is another example in the party's policy. The 18-year-old school leaver lives in Whangārei and is taking a year off studying to work full time. Nathan works 40 hours per week on minimum wage and would get an extra $530 a year.

Professional couple Ben and Tabitha are in their early 30s and have no children. They earn $150,000 each and are saving for a house. They would get an extra $2085 per year in tax relief under National's plan.

Single parent to two teenagers Simon would get an extra $90 a fortnight in tax relief and Working For Families payments.

He earns $80,000 a year and has full custody of his kids, aged 13 and 16. He would get $1043 in tax relief each year and additional Working for Families payments worth $1300.

Overall, he would get tax relief of $2343 per year.

Then from 2026, he would get an additional $76 per fortnight when the Working for Families threshold is adjusted.

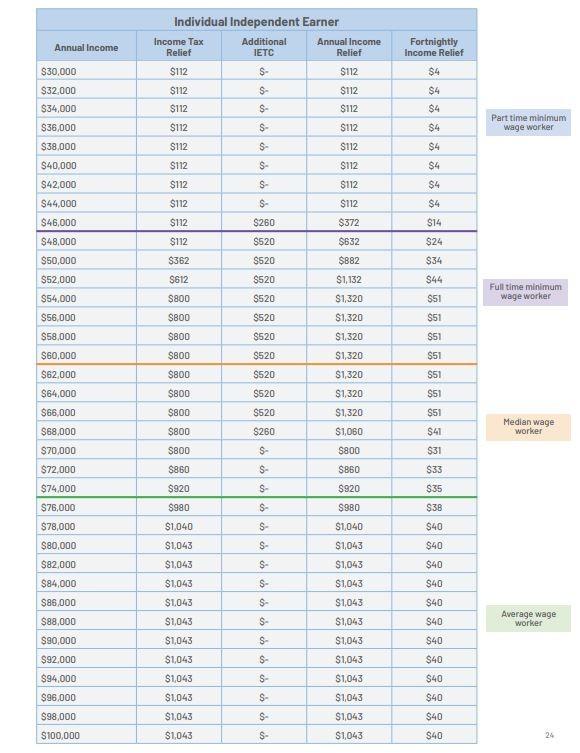

The party also realised a breakdown of how much each person would save based on their incomes and what support they're eligible for.

The first table is a breakdown of how much money a two-income household with no children could expect in tax relief based on how much they make.

The next table details how much a two-income household with one child and weekly childcare costs of $300 would get in tax relief in 2024.

Another table shows how much tax relief a two-income household with two children would get in 2024 depending on their income.

The next shows the same but for 2026 when the abatement threshold is increased.

The last shows how much an individual independent earner would get based on their income.